how much is inheritance tax in georgia

A On and after July 1 2014 there shall be no estate taxes levied by the state and no estate tax returns shall be required by the. If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of 5 of the fair market value of the vehicle.

What You Need To Know About Georgia Inheritance Tax

Georgia inheritance law governs who is considered an heir or how assets are passed down when someone dies.

. Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is worth. This is whats known as estate tax or informally as the death tax. State inheritance tax rates range from 1 up to 16.

However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206 million. Georgia state income tax rates range from 1 to 575. For 2020 the estate tax exemption is set.

The tax rate varies depending on the relationship of the heir to the decedent. Any more than that in a year and you might have to pay a certain percentage of taxes on the gift. No estate tax or inheritance tax.

If you receive a large inheritance and decide to give part of it to your children the 15000 limit per year still applies. Georgia also has no gift tax. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

Prior taxable years not applicable. Learn Georgia tax rates for income property sales tax and more so that you can estimate how much you will pay on. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000.

Check local laws to see if this might apply to you. Suppose the deceased Georgia resident left their heir a 13 million worth of an estate. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

Elimination of estate taxes and returns. The rates for Pennsylvania inheritance tax are as follows. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax.

If the estate is appraised for up to 1 million more than that threshold the estate tax can be in excess of 345000. Inheritances that fall below these exemption amounts arent subject to the tax. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

There is no inheritance tax in Georgia. In this case 940000 would be subject to a Federal Estate. The estate of the deceased person itself is eligible for federal taxes if it is worth above a certain level which is 11580000 in the 2020 tax year.

No estate tax or inheritance tax. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. This increases to 3 million in 2020 Mississippi.

Another states inheritance tax could still apply to Georgia residents though. States may also have their own estate tax. 0 percent on transfers to a.

Surviving spouses are always exempt. In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax unless your estate is worth more than 1206 million. New residents to Georgia pay TAVT at a rate of 3 New Georgia Law effective July 1 2019.

As of July 1st 2014 OCGA. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. 404-410-6820 email protected Home.

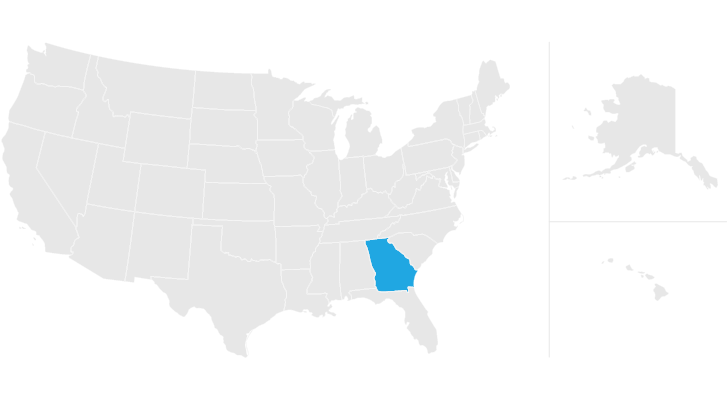

48-12-1 was added to read as follows. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Does Georgia Have an Inheritance Tax.

As of 2014 Georgia does not have an estate tax either. The exemption was 117 million for 2021 Even then youre only taxed for the portion that exceeds the exemption. Learn everything you need to know here.

As of 2018 an individual can give another person up to 15000 per year as a gift tax-free. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. For instance in Pennsylvania the inheritance tax applies to heirs who live out of state if the decedent lives in the Keystone State.

The top inheritance tax rate is18 percent exemption threshold. Based on the value of the estate 18 to 40 federal estate tax brackets apply. No estate tax or inheritance tax.

Twelve states and the District of Columbia also charge estate taxes though the sizes of the estates they exclude are much smallerfrom about 1. The top estate tax rate is 16 percent exemption threshold. After any available exemption you could owe 18 to 40 percent in taxes depending on the taxable amount.

As of 2021 only estates worth more than 117 million are taxed and only on the amount that exceeds that number. There is no federal inheritance tax but there is a federal estate tax. Inheritance taxes also known as estate taxes are the taxes paid on the property left to the heirs of a deceased person.

Does Georgia have an estate tax. Estate Tax - FAQ.

The Proposal 1942 By Kurt Schwitters 1887 1948 Andrea Abagnale Kurt Schwitters Art Photomontage

Keith Cochran P C Certified Public Accountant Cpa Serving The Chattanooga Area And Northwest Georgia Certified Public Accountant Money Matters Cpa

Twelve Tax Exemption States For Federal Retirees Retirement Benefits Institute Retirement Benefits Tax Exemption Retirement Financial Planning

Taxation In Georgia No More Tax

Does Georgia Have Inheritance Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

What You Need To Know About Georgia Inheritance Tax

Georgia Estate Tax Everything You Need To Know Smartasset

The Updated Version Of The Terrible Towel Dailysnark Com Steelers Pittsburgh Pittsburg Steelers

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Georgia Estate Tax Everything You Need To Know Smartasset

Uk S Tax Wastage Planning Infographic Inheritance Tax Tax Infographic

He Has A Point Lear New Yorker Cartoons King Lear Cartoon Posters

Property Investment Financial Planning Inheritance Tax Ltd Company Versus Private Personal Ownership Anyone Inheritance Tax Investment Property Inheritance

Inheritance Tax Here S Who Pays And In Which States Bankrate

Find Out What The Difference Is Between A Trustee Power Of Attorney And An Executor Mestayer Goodtoknow Lawterms Power Of Attorney Attorneys Power

Georgia Estate Tax Everything You Need To Know Smartasset

Estate Planning Estate Planning Estate Planning Checklist How To Plan

Watch Mail For Debit Card Stimulus Payment Prepaid Debit Cards Debit Card Visa Debit Card